Your property tax bill or payment receipt has information that can help you complete the Truth in Annexation worksheet. You can look up your tax bill through the Pinellas County Tax Collector’s website.

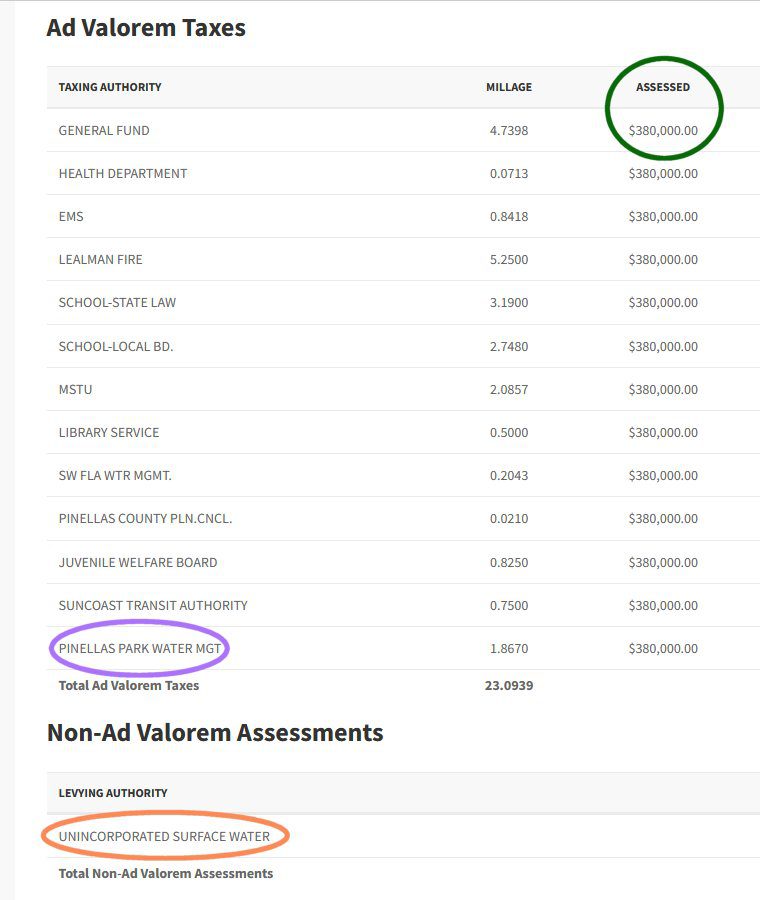

You will see a results page that looks similar to the one below. The circles indicate places where you can find information that will help you complete the Truth in Annexation worksheet. Some helpful hints appear below.

Worksheet Questions:

- The “Assessed” amount, circled in green on the image above, points to the information you need to answer question #2 on the worksheet. (It’s equivalent to “Assessed Value/SOH Cap” from the Property Appraiser’s Office database.)

- The “Unincorporated Surface Water” line, circled in orange on the image above, shows the information you need to answer question #12.

- The “Pinellas Park Water Mgt. District” line, circled in purple on the image above, shows the information you need to answer question #13. This item will be listed on your tax bill only if your property is located in the district.

Please note! The millage values on your property tax bill are from the previous year. Therefore, they may not match the property taxes calculated by the Truth in Annexation worksheet.

The Property Appraiser’s Office database can provide additional information to help you answer other questions. Click here for a link and helpful hints.